By Alec Cope

We Are Change

The New York Stock Exchange was shut down do to “technical difficulties“, China is mirroring the US stock crash of 1929 and Greeks banks won’t open for a week.

What is going on?

This has been a very interesting week in terms of financial operation (and meltdown) for several large establishments. Clearly the internationally integrated monetary system is interwoven and therefore one arm will affect another. These recent events have painted a picture that depicts the true shakiness of this financial turmoil.

Our friends over at Anti-Media, have alluded to the idea that the hacker collective Anonymous, hacked the New York Stock Exchange. This was suggested as a Twitter account known as @YourAnonNews Tweeted this ominous comment yesterday:

Wonder if tomorrow is going to be bad for Wall Street…. we can only hope.

— Anonymous (@YourAnonNews) July 8, 2015

If this were true, what would this mean for the fiat monetary system?

The China Bubble

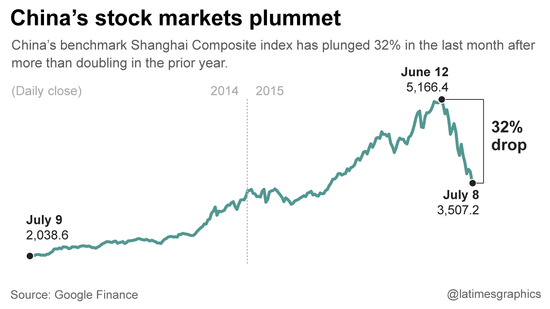

As that unfolded, China’s securities regulator banned, “major shareholders, corporate executives and directors” from selling certain stocks for 6 months, this action took place 2 days ago. To add to the already tense and unpredictable event, China experienced extensive stock market destabilization to the extent some are calling this “China’s 1929“. Basically implying China may be about to experience a significant crash that would be detrimental to US and most likely global markets. Chief capital market economist for Moody’s Analytics, John Lonski said this in light of China’s situation:

“That’s incredible … that’s scary.”

As the author I would also like to emphasize I am not attempting to spread fear – only the gravity of this borderline crisis. It is entirely up to you on how you react to this information and more importantly, what you DO with it.

What China experiences economically, the US will experience inevitably as well (as will the Bilderberg created Euro), so this is something to pay attention to as it may usher in a domino effect.

The Battle of Greece

What Greece is experiencing currently, can happen anywhere and it is my opinion that there is so much more going on behind the scenes then what has been reported. An example to demonstrate this is the recent resignation of outspoken Greek Finance Minister Yanis Varoufakis. He claims he made the move after creditors viewed him as an “obstacle” to their agenda and would like to see him “removed”.

I couldn’t see this being the truth, as Varoufakis actually got the outcome that he yearned for. The Greeks voted no on allowing international cartel syndicates such as the IMF to further loot the Greeks. After this satisfactory victory for Varoufakis – he resigns? After being so outspoken, now he steps down after creditors wanted him removed? At the most critical time frame too? I do not believe that what we have been told is all that there is to this story. Could he have received death threats for his “against the stream” position?

After the referendum (learn more from the WRC videos below), the Greek Republic also has the feasible option to join the BRICS monetary construct as well. US and European leaders have no desire to see Greece leave the Eurozone, as other nations such as Portugal, Italy and others may do the same if Greece exits. The action would easily destroy the EU hegemony, so Greece is being made an example of, “See, this is what happens when you don’t play along.” Perhaps it is why the same EU leaders have been so aggressive in preserving all aspects of the Union via Greece’s current treatment. How can this not be the case when European leaders are saying the next few days can be:

“… the most critical moment in the history of the EU.“,

We can see the dramatic picture being laid before us. Despite all of this, the Greek Finance Ministry has said that concrete reform proposals will be out by Thursday and it has applied for a 3-year loan from the European Stability Mechanism. At this point in time however , Greek banks/ATMs will not have any cash for the week. This is a very unfortunate situation, as people have been limited in the amount of Euros they can pull out of their own bank accounts, all while Greece suffers from extreme cases of unemployment and desperation. For more WRC coverage on Greece see the videos below.

All of these situations paint a very volatile picture; a portrait of what we have allowed to manifest on one level or another. Truly this should sober anyone who has been guzzling the kool-aid: something is happening and happening very quickly. We must keep ourselves vigilant as these days unfold, there’s no telling what could happen tomorrow.

Thanks for reading.

The post Greek banks won’t open, China stocks plunge and the Stock Exchange shuts down – what’s happening?? appeared first on We Are Change.